New but Few Condominium Projects Coming to Downtown Seattle

Realogics Sotheby’s International Realty recently announced that for the first time in a decade, their brokers are representing ten new multi-family for-sale condominium and townhome projects in downtown Seattle and its surrounding neighborhoods. Though project specialists admit the cycle is a mere fraction of the last one, the spur of activity has caused the firm to relaunch the UrbanCondominiums.com website and a New Developments Preview Center in Belltown at 2715 First Avenue in Seattle. These resources will help potential buyers learn more about what’s currently for sale, what’s coming next, and equip them to combat today’s competitive in-city condo market.

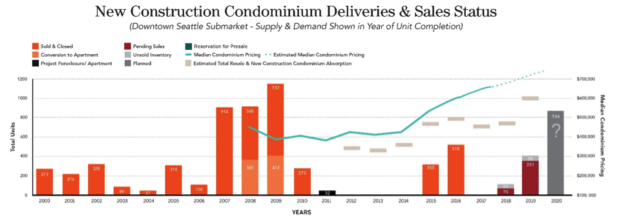

Though demand for homeownership in Seattle has grown substantially over the past few years, developers have continued to build primarily apartments for rent, rather than condos for sale. As RSIR reports, 94-percent of the 27,000 new housing units being developed in the current decade will deliver for lease rather than purchase.

As Dean Jones, President & CEO of RSIR notes, “a sustained supply and demand imbalance has led to dramatic median home price increases in downtown Seattle where resale properties in 2017 experienced a 19-percent jump over the prior year. Today we find fewer than three dozen active listings in an urban district of more than 80,000 residents and the median asking price is now $1.2 million. Clearly, we need more inventory choices for purchase.”

Ten years ago, there were more than a dozen condominium projects advertising presales with more than 3,000 units in planning and development. Mortgage lending and consumer confidence were strong, yet record sales were followed by a recession and construction capital and consumer confidence fell.

A chart produced by RSIR illustrates the lack of new condominium availability despite strong demand for in-city homeownership opportunities.

“About ten years ago, our firm, Realogics, Inc. was representing a number of planned and developing high-rise condominiums in and around downtown Seattle,” Jones adds. “Then it suddenly became clear that construction financing was crimped and projects that weren’t started were stopped in their tracks. Other projects began recalibrating to the new market realities and it was the beginning of the end of that condo cycle.”

The Dow Jones Industrial Average has nearly doubled in value since its low point in 2010.

Today, the market fundamentals in downtown Seattle are far different than they were a decade ago, and the city is in a much stronger economic position than before. As Jones says, the tech industry has contributed to sustainable employment, while in-city renters, a growing traffic issue, and Seattle’s cultural offerings are pushing many to consider homeownership within the downtown core when available.

“It’s a much better fundamental picture to the conditions we experienced in the middle of the last decade yet we have a fraction of the new condominiums today compared to back then,” says Jones.

Seattle jobs decreased significantly during the recession, but have long since recovered thanks to thriving tech companies such as Amazon. (Source: DowntownSeattle.org)

What’s more, is the mortgage industry operates under much stricter guidelines and with many more safeguards than ever before.

“We’re not in the same situation as we were the last time we saw robust condo demand – we’re qualifying our buyers very carefully which limits the number of speculators in the market,” says Trevor Bennett (NMLS#317162), a Mortgage Banker with Caliber Home Loans. “The mortgage free-for-all conditions that were present before the correction are just not present now. If anything, we appear to be undersupplied in for-sale housing and the real challenge is rising property costs, increasing interest rates and diminishing affordability.”

Above & Below: Homes sold and available for sale below $750,000 have dramatically declined in the resale market, while few new construction projects struggle to provide a substantial number of homeownership opportunities at more attainable price points.

Browse what’s currently in the RSIR New Development Pipeline on the Interactive Map Below: