A Renewed Prosperity Cycle

Home values typically decrease from October to December based on seasonal data in the Seattle-Bellevue metropolitan area. However, the exogenous events indicated in my September 2019 forecast that could maintain or stimulate an increase in home values before 2020 may be aligning in November-December 2019. Regardless of the timing of these events, now is a good time to Buy while interest rates are lower (e.g. below 4%) and before home values appreciate in 2020 (approx. +10%).

Forbes, November 15, 2015, 2020 Real Estate Outlook: Expert Predictions For Mortgage Rates, Home Prices, Tech And More

In summary, real estate market catalysts include the recent Federal Reserve rate reduction on October 30th, the new North American trade agreement (USMCA) that could be ratified in November (ref: House Ag Chair: USMCA Vote As Soon As Next Week, Washington Week Ahead, A New Window for USMCA Movement, Nancy Pelosi says a USMCA trade deal breakthrough could be ‘imminent’) and the Phase 1 China & U.S. trade deal (ref: China Says It Will Strive To Reach ‘Phase One’ Trade Deal With U.S.) that should be signed before mid-December.

Politco, November 27, 2019, Trade ministers are close on changes to U.S.-Mexico-Canada deal

South China Morning Post, November 28, 2019, Official: ‘Millimetres’ separate US, China from phase one trade deal

As a result, the stock market would sky rocket, which has traditionally been an indicator of the macro economy, and the Dow could reach 30,000 before 2020; be aware mortgage interest rates tend to follow the stock market, so if stocks go up interest rates may follow. Both of these historic reciprocal trade agreements could reinvigorate the U.S. economy’s current prosperity cycle while benefiting the global economy that’s currently in recession.

The Dow Jones Industrial Average as of November 18, 2019.

Global growth (currently, a "synchronized slow-down" according to most economists) is forecast at 3% for 2019, its lowest level since the 2008–09 international financial crisis. Major drags on global growth have been trade barriers and geopolitical tensions. The global economy will likely improve if these trade barriers are removed and improved. Moreover, mutually beneficial trade fosters peace, which will further ease geopolitical tensions.

Generally, home sales in King County (Seattle-Bellevue areas) increase from January to May and begin decreasing until January with a surge of activity in September to October in some micro-markets (neighborhoods) as previously indicated in September 2019 reporting. The following graph was included in September’s report based on NO positive exogenous events in 2019:

However, the quantity of properties going under contract has been increasing every month beginning in August as indicated in the graphs below.

Housing Wire, November 19, 2019, Building permits climb 14.1% above the October 2018 rate

In early November, I’ve helped 2 different home Buyers win multiple offer situations (under $1M). One property received 7 offers and the Purchase Price escalated 9% ($67K) while another listing received 4 offers and escalated 18% ($142K). I have not seen this level of activity since before the May 2018 price correction (see articles, May 2018 Price Correction: What to Make of Seattle Market Cooldown, Annual Rate of Home Price Appreciation Falls to a 7-Year Low).

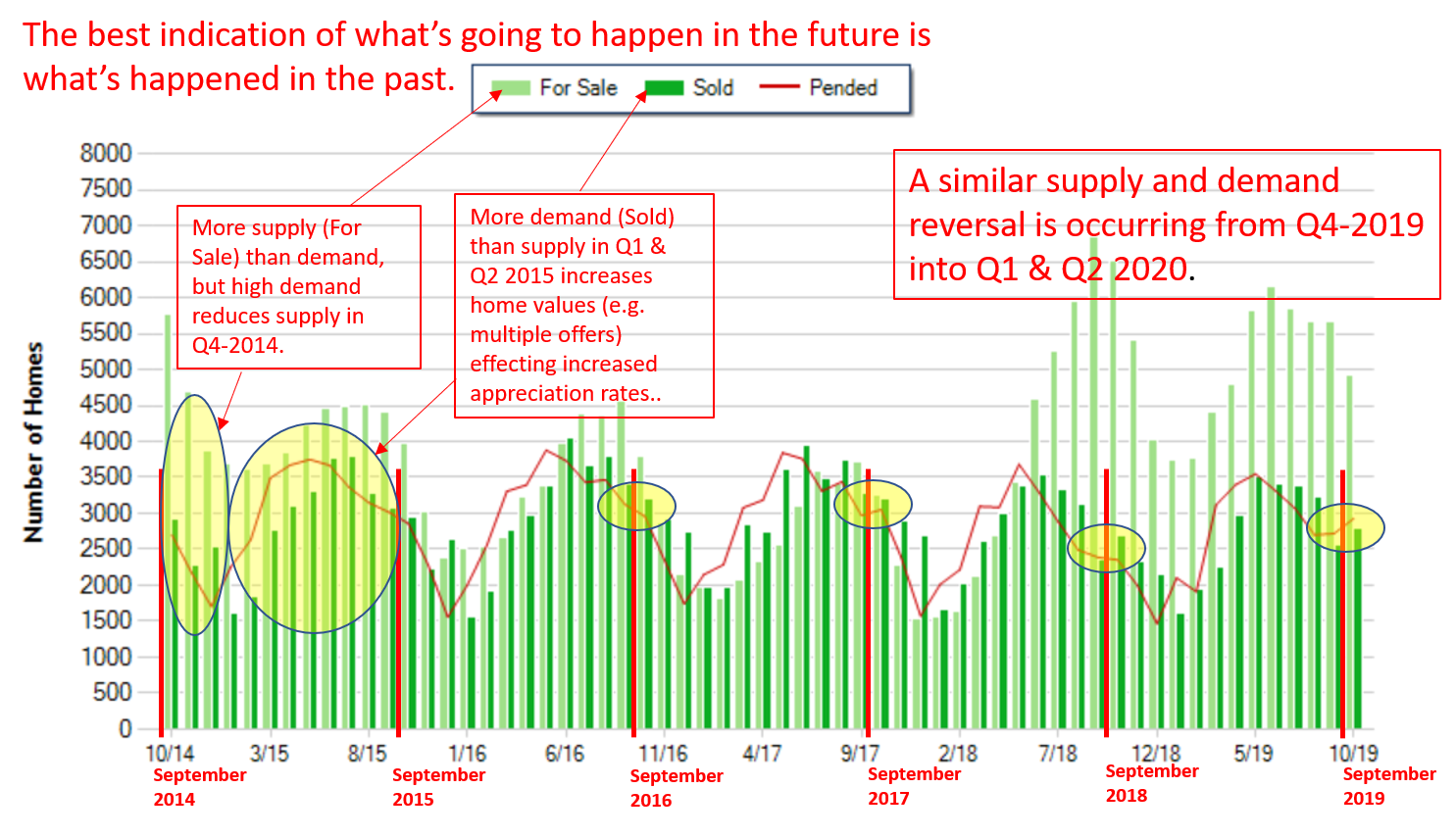

Currently, fewer and fewer Sellers are listing their properties for Sale as we head into the holiday season while there is increased Buyer activity reducing supply (inventory). This inventory supply (homes on the market) could be significantly decreased prior to Q1-2020 and, therefore, a stronger Seller's market could be effected in 2020 that could effect a higher rate of appreciation for home owners. A similar supply and demand reversal occurred from 2014 to 2015 as indicated below:

As of October 2019, we continue to have a strong Seller’s Market with 1.5 months of inventory; less than 3 months is considered a Seller’s Market. The table below indicates the similarities from Q4-2014 to Q1-2015 relative to Q4-2019 and what could be Q1-2020:

The following appreciation rates are based on average single-family home sales in King county:

2014: 6.73%

2015: 9.52%

2016: 9.16%

2017: 17.95%

*2018: -2.50%

*See article on May 2018 Price Correction: What to Make of Seattle Market Cooldown.

As of October 31, 2019, there has been a 7% rate of appreciation in 2019. I believe there will be over +10% appreciation in 2020. The average home price appreciation rate in the U.S. is between 3% to 5%.

Now is a great time to Buy real estate in the Seattle-Bellevue area. If you’re thinking of Selling a property, I recommend waiting to list from as early as the last week of February 2020 and no later than the first week of May for optimum results.

Be aware the current 1.78% real estate excise tax (REET) on property sales will change on January 1, 2020. Please note the graph below:

Please contact Washington state senator Joe Nguyen, if you have any comments on this graduated REET revision structure.

It’s interesting to note the average single-family home sale in King county is $808,000 as of October 2019. Seattle is ranked no. 5 in the U.S. with an 11% share of million-dollar homes (see article, Here are the 10 U.S. cities with the biggest share of million-dollar homes). I've had 21 closings in 2019 and my average property sale is $1,116,452. See my recent Sold Stories here.

The following are comments from the chief economist of a competing real estate brokerage (+300 offices / +7,000 agents) on November 15, 2019: